How Are Assets and Liabilities Connected to Net Worth?

Estimated reading time: 6 minutes

Table of contents

The amount by which your assets surpass your liabilities is your net worth. It is just the difference between what you possess and what you owe. You have a positive cash flow if your assets surpass your obligations. In contrast, if your obligations exceed your assets, you have a negative net worth.

The value of a person or corporation may be calculated by subtracting the total liabilities from the total assets possessed by the individual/organization.

A person or corporation is considered to have a positive net worth if its assets exceed its liabilities. If the obligations exceed the assets, the available means are negative. Positive cash flow is connected with excellent financial health, while negative net worth is interpreted negatively and indicates an incapacity to satisfy obligations.

Available means may be utilized on a variety of levels. It may be used by a single person, a group, a company, a government, or even a whole city or nation. To keep things simple, we’ll confine our discussion to the net worth of people or businesses.

It happens that the situation is not going well and you need to urgently receive money before the salary to cover unforeseen expenses. In this case, a credit card with 1000 limit can help, where you can instantly receive money, and then give it back as much as possible. In some situations, this helps a lot, but you need to treat it wisely.

What Is a Good Net Worth?

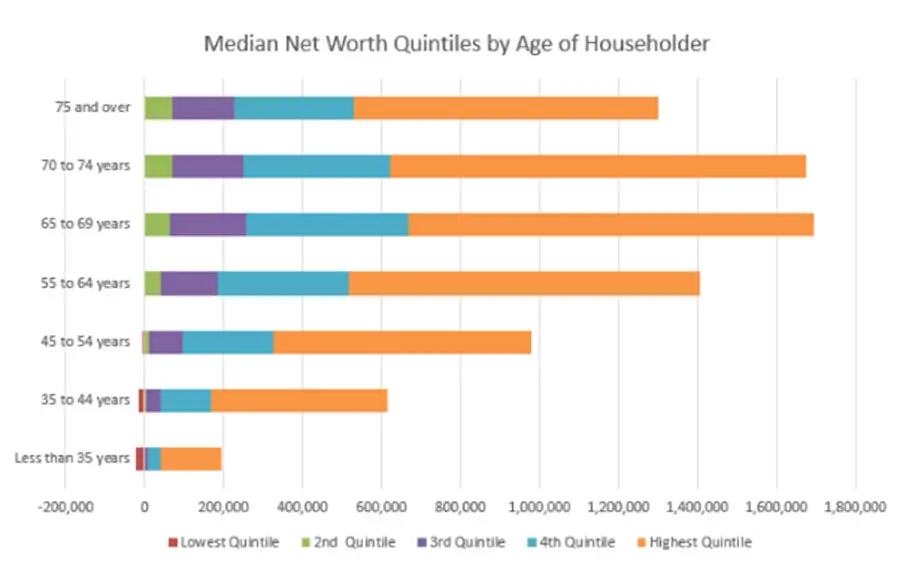

Determining what a “good” available means will differ from person to person, depending on their life circumstances, financial demands, and lifestyle. In 2019, the average net worth of a person in the United States was $121,700.

Your net worth may vary significantly from the entire value of your assets. A person with a fancy home and automobile but significant auto loan and credit card debt, for example, may have a much lower cash flow than it seems.

Even a billionaire might have a low net worth if their fortune is substantially leveraged against real estate assets. You have a negative available means when you owe more than you own. You have a positive available means when your assets exceed your liabilities.

Personal Capital reports that the typical American has a net worth of $6,676 at age 35, $35,000 at age 40, $84,542 at age 50, $143,964 at age 60, and $194,226 at retirement age. As a result, you should be responsible and work to continuously build up your good net worth.

The following formula may be used to calculate net worth:

Assets – Liabilities Equals Net Worth

Assets Examples

Assets are items that have a monetary value. Assets include the following:

- Cash is money that is often maintained in bank accounts, such as checking accounts, savings accounts, individual retirement accounts (IRAs), and emergency reserves.

- Bonds: A bond is a debt provided to an organization in return for interest by an investor.

- Stocks are ownership shares in a company’s earnings and assets that may be exchanged on the stock market depending on the stock price.

- Real estate is the transactional sale or purchase of real property, which includes not just the land itself but everything permanently tied to it.

- Furniture, gadgets, collectibles, and vehicles are just a few examples of tangible products.

- Mutual funds are professionally managed investment portfolios of stocks, bonds, securities, and other assets that are financed collectively by a group of investors.

- Home equity is the difference between a home’s current assessed worth and the amount owed on its mortgage.

- Annuities are set sums of money that are deposited on a regular basis. Pensions are categorized as annuities.

SEEL ALSO: The 6 Major Asset Classes, Explained

What Is the Process of Calculating Net Worth?

Available means start with the overall amount of your possessions, often known as your gross worth. It deducts different obligations from those assets. Personal loans, school loans, vehicle loans, credit card debt, house mortgages, and past-due taxes are examples of common liabilities.

When such expenses are deducted from your assets, a better picture of your financial health emerges. For example, if you own your home entirely, you may have a high net worth since the property is a valuable asset without the obligation of a mortgage. On the other hand, if you have a high-interest mortgage, you must deduct that debt from the value of the property, lowering your total net worth.

How to Determine Your Net Worth

As previously stated, you may determine your personal net worth using the following equation:

Total asset value – Total liability value = Total net worth valuation

Asset Calculation

Everything that has a monetary worth is considered an asset. It may include an individual’s goods such as a home, automobile, or piece of art, as well as their bank accounts, insurance policies, and investments. Clothing and furnishings are not typically considered assets since they are not auctioned off in the case of bankruptcy or liquidation.

Liability Calculation

Any financial commitments that must be repaid are classified as liabilities. Debt includes loans, mortgages, rent, and bills. When estimating obligations, use current repayments rather than those that will be due in the near future.

For example, if we are calculating an individual’s net worth at the end of the year and they pay their electricity bill each month, we will only take the amount due for that month and exclude any future sums for January or February of the following year.

However, home rent may be considered differently in certain circumstances since most lease payments are for a year, therefore a complete year’s payment may be viewed as an obligation. Rent is usually excluded from net worth estimates.

SEE ALSO: When Auto-Paying Your Bills Isn’t Always the Best Solution

Net Worth Calculation

After listing all assets and obligations, just subtract the liabilities from the assets to calculate the net value. It may be used to measure an individual’s financial health and can be done once or numerous times each year. Organizations go through the same procedure.

To make an accurate estimate, non-cash assets must be assessed at their current market worth. Consider whether you want to calculate your own net worth or such worth you share with a spouse or partner.

A financial adviser may assist you in swiftly calculating your personal net worth if you have several inputs that confuse the calculation. Some websites include cash flow calculators that enable you to input all of your personal assets and obligations into a calculation, but be aware of businesses that ask for more personal information.