Stop Writing Checks and Start Using Venmo

Estimated reading time: 8 minutes

Table of contents

If at the end of every meal out with friends and family, you find yourself spending longer on working out who bought what and deciding how much everyone needs to tip, then you’ll love to hear about why Venmo is such a fantastic alternative. The old ways of writing checks and searching through your wallet to find pennies hiding away are over. Now, it’s all about the app.

It eliminates those tiring days of scrambling for ATMs, promising friends you’ll pay them back, and worrying you never have enough cash on you. Instead, Venmo provides a simple and straightforward solution to pay people back, reimburse your friends and neighbors, and make sure you pay the babysitter on time. But what is Venmo all about?

What is Venmo?

Venmo was launched in 2012 and is available on both iOS and Android devices. It’s a free app owned by PayPal and allows you to transfer money to and from accounts quickly.

It allows you to send money and also request payment from friends who also use the service, and it’s ideal for those who have given up carrying cash with them, because who needs that hassle anymore?

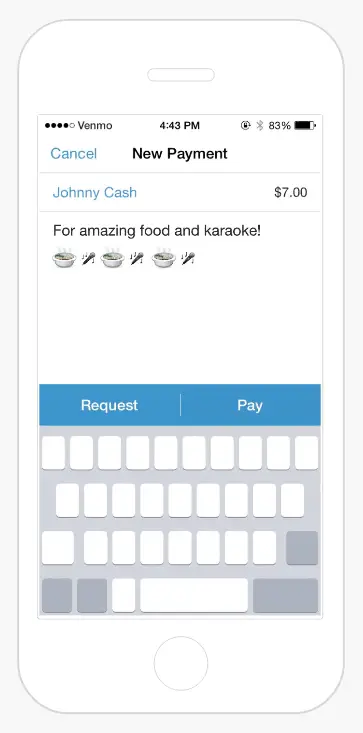

Image Source: Venmo.com

With instant payments and a secure network, Venmo is becoming a popular choice for young go-getters all across the country, you may have even heard people asking others to Venmo them their half of the bill, and now you can get in on the action.

How Does It Work?

Venmo might seem a little complicated to the outsider, especially someone who’s not so up-to-date with the latest tech trends. However, it is actually remarkably simple. So simple, in fact, that even if you’ve never used a smartphone before, you’ll be able to figure it out.

It works by linking your bank account to the app with either a credit or debit card. Because it is connected to one of these accounts, you won’t need to add money yourself manually. However, if a friend transfers money to you for the cab fare, then you will need to manually withdraw it so that it appears in your bank balance.

What Can You Use Venmo For?

Part of what we love about Venmo is the convenience, and there are many situations where it can come in handy for you and others. While there is likely no limit to what you can use Venmo for, here are some of the most common situations where you will be thankful you use Venmo.

Split the Bill

If you’re tired of paying more (or being shamed for paying less) every time you head out for a meal with friends, you can use Venmo to split the bill so that everyone pays their fair share. It’s not just for dinner and drinks, though. You can also use Venmo to split the cab fare.

Reimburse Friends and Family

We’ve all had those times where we’re just a few dollars short before payday, but someone has come to our rescue and helped us out buying tickets to a show or the big game, or treated us to a pizza when down on our luck. Venmo allows you to reimburse friends and family, so you never feel that sting of debt hanging over your head for too long.

SEE ALSO: Does Having Less Money Cost You More?

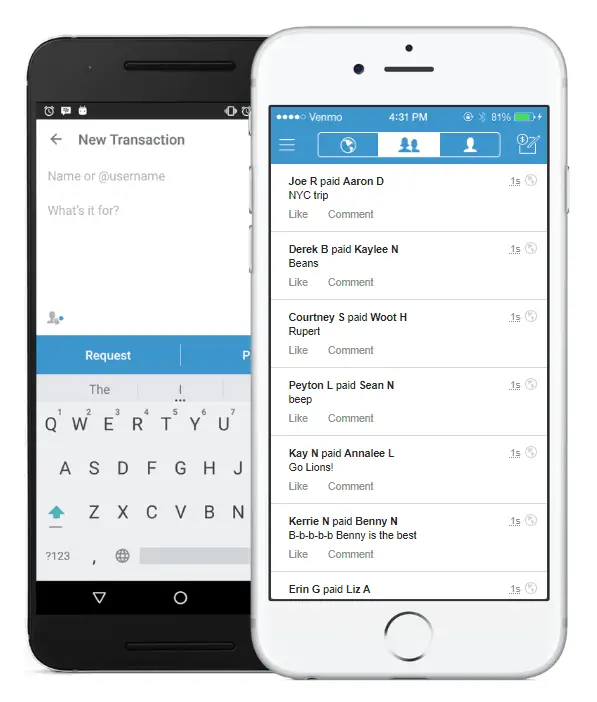

Image Source: Venmo.com

Pay the Sitter

If you and your partner have been out for a date night and left your daring children or pets (or both) in the care of the sitter, you might come back without any cash on you. Thankfully, you don’t need to send the sitter home empty-handed; use Venmo to help them grab something to eat on the way back.

Pay the Rent

Usually, there’s one person in the apartment that pays the bills, so to ensure you offer your side of the costs are sent promptly and securely. No one likes that guy who skimps on their part of the bills, so make sure you pay up when you need to.

In addition to these straightforward uses, you can add a note to each payment, so the payee understands why they’re receiving this money. This can be ‘Dinner’, ‘Rent’, ‘Basketball tickets’, or whatever you’re paying up for. And just for fun, emojis are fully supported and encouraged here.

How to Set Up a Venmo Account and Balance

Setting up a Venmo account is simple, too. All users need to do is download the app (the app that’s free, by the way), and put in their details. Venmo offers the option to connect your Venmo account to your Facebook account, if you’re still on Facebook, that is, but you can also sign up using your name, email address, and mobile number.

Once you’ve signed up, the app will ask you to verify your phone number. After verifying through text, you can start setting up and connecting your debit or credit cards, depending on which one they prefer. If you want to deposit any balance that you accrue through using the app, you can also connect your bank account, but this is not mandatory.

Now that you’re all set up, you can start finding contacts who already use the app, and you can invite friends and family to join, too.

Is It Easy To Use?

Just like Venmo is easy to set up, it’s also easy to use. The layout of the app is straightforward. There is a Pen and Paper icon in the top-right corner of your smartphone screen which you can use to make payments or request charges. You can do this for an individual or to a group of people if you were the one tasked with paying the bar tab that night.

You will, however, need to ensure that you input the decimal points; otherwise, you risk sending thousands of dollars over to friends and family, and they could flee with that cash, and you never see them again. They also might not, but it’s always better to be safe.

Sending money with your bank account is typically free. However, payments tied to a credit card will incur a fee. This is usually 3% of the amount sent. The money usually leaves or arrives in your account the next business day at the latest.

Venmo also includes verification for charges and payments. This means you need to approve any transaction that you make or receive over the app, and unless you do this, Venmo will not deposit or withdraw money from your accounts.

There is the option to assign ‘Trust’ certain friends, and these do not require verification, making any payments or charges immediate. For people who regularly share lunch, drinks, or cabs, this takes a lot of hassle out of splitting costs and keeps all payments regularly up to date.

Sometimes, you may send a request for money but not receive anything back. When this happens, Venmo allows you to send reminders to the payee. If this still doesn’t work, get in touch in person to find out if there is an issue.

Where Can You Use Venmo?

You can use Venmo almost anywhere, and if you keep payments in your Venmo account, it is possible to use the app across millions of websites. As PayPal owns Venmo, you can make these purchases and transactions through PayPal. However, you can also use it directly in certain apps.

If you only want to use Venmo to collect money owed by friends and family, you can transfer your Venmo balance directly into your bank accounts, keeping your Venmo balance empty until you receive another payment.

What About Privacy?

Because of the social aspect surrounding Venmo, it’s essential to understand the privacy features that ensure your bank details and other information are kept secure. Venmo uses layers of encryption to guarantee your details remain safe and prevent fraud.

Its bank-grade security systems ensure that you can feel confident using the app, while any payments will only be made public to friends and family who you transfer to and receive money from.

The setup protects you from unauthorized charges and also ensures personal information is hidden. Should your device get lost or stolen, Venmo offers an option to freeze the app and cancel any attempts to use it that are not your own.

To further protect yourself from mistakes and financial mistreatment, it’s wise to use Venmo only to transfer smaller amounts, such as those for pizza or cab fare. You should not use it as a primary bank account, nor keep all of your money in your Venmo balance. This is simply common sense, but it helps ensure your money is protected through conventional banking means.

When making or receiving payments, it’s also always important to decide on the amount of money owed before making the transfer to ensure happy parties on both ends.

Transferring Money Has Never Been Easier

With such a range of cool, fun, social, and ultimately useful features, it’s no surprise that Venmo is becoming more and more popular across the world. Society is shifting closer and closer to being entirely cashless, and carrying around dollar bills and changes feels increasingly inconvenient. By using Venmo, you can stay ahead of the trend and make any payment, transfer, or transaction more straightforward than ever before with just the tap of the screen and a smile.

Still a little confused? Watch this short video to learn how easy it is to send and receive money with Venmo for free.