Beyond the Shopping Cart: Checking Out with PayPal.com [ARTICLE]

What Is PayPal

If you shop at eBay, you may be familiar with PayPal as the preferred payment option. But you can make PayPal your pal for much more. Whether you want to collect funds for the girl’s night out, send money to your college student, or pay for the fishing pole on a local hobbyist’s website, PayPal is a convenient and secure way to send and receive money online, and it offers services far beyond checking out items in an online shopping cart.

If you shop at eBay, you may be familiar with PayPal as the preferred payment option. But you can make PayPal your pal for much more. Whether you want to collect funds for the girl’s night out, send money to your college student, or pay for the fishing pole on a local hobbyist’s website, PayPal is a convenient and secure way to send and receive money online, and it offers services far beyond checking out items in an online shopping cart.

How It Works

PayPal is a Web-based financial broker that acts as a trusted middleman to securely hold your funds. Account holders easily and securely transfer funds to each other’s email addresses. Since PayPal brokers the transaction, buyers and sellers never see the other person’s financial information (like credit card or bank account numbers).

Savvy users turn to PayPal for sending money to friends and family, selling stuff, requesting money, getting paid for a service or product and even donating to a charitable cause. Using PayPal means no hassles with money orders, checks or stamps, and you avoid giving out precious credit card or other financial information to multiple people or websites.

Getting Started

Getting started is free and easy. To open an account, browse to paypal.com and choose “Sign Up” You can choose from several different account types, but most noobies will want to begin with a “Personal” account. Setup is free, and you can upgrade any time.

To begin, PayPal asks for an email address, password, mailing address, phone number and a bank or credit card account. Or, use cash to buy a Moneypak® from a variety of local retailers if you do not have a bank or credit card account. As soon as you set up an account, you can start purchasing, sending money, selling or donating.

Buying With PayPal

Many online stores offer to let you “Pay with PayPal” when you check out your shopping cart. If you make that choice, the site will seamlessly and securely redirect you to PayPal and prompt you to login using your username (also your email address) and password.

Once you’ve logged in, PayPal offers a variety of payment options to pay for your purchase:

- Your existing PayPal balance

- A bank account

- A credit card

PayPal will always suggest that you draft from your PayPal account balance first, a bank account second, and a credit card third. If your purchase amount exceeds your PayPal account balance, use one of the other two options to cover the difference. PayPal also offers a Bill Me Later service; more on that in a minute.

If you have a PayPal account, but you’re shopping on a site where the vendor uses PayPal’s merchant services to let you pay with a credit card, be careful. PayPal may actually recognize your credit card details (if you’ve previously registered them to your PayPal account). As a result, PayPal will force you to login and authorize a payment through your PayPal instead—a frustrating and somewhat time-consuming requirement if you’re not a frequent PayPal user. You can still use your credit card, but plan on jumping through a few hoops.

Send Money

For vendors that don’t offer their own payment processes, start from your PayPal account to complete a purchase. This solution works great for purchasing a guitar from an out-of-state shop, chipping in for a gift, making eBay purchases, paying back a loan from your sister or other person-to-person financial transactions. You’ll maintain the privacy of your financial information and PayPal will protect you from fraud.

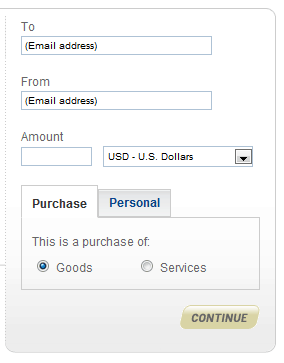

From the “Send Money” tab you’ll add the recipient’s email address and a dollar amount. Use the default “Purchase” for eBay transactions. Sellers and vendors pay a fee for the transaction, but you will always have the option to send money for free. All money recipients, from your sister to eBay auctioneers, will receive notification of your payment by email. They can then withdraw their funds from PayPal, transfer them to their bank account, request a check from PayPal, or keep a PayPal balance for future online spending.

Sellers: Requesting and Accepting Money

If you want to sell something on your website, you can use your PayPal account to accept payments. PayPal makes it easy to sell with simple-to-use “Buy Now” buttons, or you can apply for a full-fledged merchant account with a virtual terminal.

When a buyer selects PayPal to purchase an item on your site, the money shows up in your PayPal account. PayPal sends you payment confirmation then you ship an item or complete a service to finish the transaction.

If you need to remind buyers that payment is due, use the “Request Money” tab then “Create a Money Request” or “Create an Invoice.” You can send these types of requests for money to anyone with an email address, even if they do not have a PayPal account.

Payment options

PayPal for students helps kids age 13 and older learn to manage money by giving them a preloaded PayPal Debit MasterCard that stays linked to a parent’s PayPal account. As a parent who wants to setup a student account, you should login to your own account then under the “Products and Services” tab select “Student Account” then “Get a Student Account.” PayPal offers customizable features like low-balance and excessive-purchase alerts to help parents and students track teen transactions. The card has no fees for maintenance, loading funds or making purchases. Some low fees apply to cash withdrawals and other select transactions, so visit the fee schedule for exact details.

Not just for students, the PayPal Plus MasterCard offers PayPal security and convenience combined with MasterCard Platinum benefits.

PayPal also offers a Bill Me Later service that allows you make purchases at many online stores using a virtual credit account. You’ll first need to walk through PayPal’s quick approval process, and because it is a credit account, finance and interest charges will apply to balances not paid in full by payment due dates.

How PayPal Makes Money

PayPal primarily makes their money on sellers’ transactions. Buyers almost never pay fees. Sellers who are set up as “merchants” always incur transaction and finance fees on “Purchase” transactions.

On the other hand are recipients of “Personal” funds who may incur transaction and finance fees if the sender pays with a credit card. Fees for either option can vary by country of origin, currency and transaction amount, but a starting point is 2.9 percent plus $0.30 per transaction.

Security and Buyer Protection

PayPal offers state-of-the-art protection against fraud and unauthorized payments as well as round-the-clock transaction monitoring to help keep your personal and financial information safe. Their comprehensive fraud protection center offers answers to your questions and the help you need should in the case of a crisis.