Don’t Pass It Up, Pay It Up with Online Bill Pay

Bills lay exposed in your overstuffed mailbox. Paper checks freely display personal and financial information. And, the cost of stamps is starting to impede your daily coffee habit.

Bills lay exposed in your overstuffed mailbox. Paper checks freely display personal and financial information. And, the cost of stamps is starting to impede your daily coffee habit.

These are only a few reasons to give online bill pay a second look. Online bill pay is paperless, inexpensive, highly secure, postage-free and easy to use. And with seventy million households making their payments online in 2009, you’ll be in good company.1

How It Works

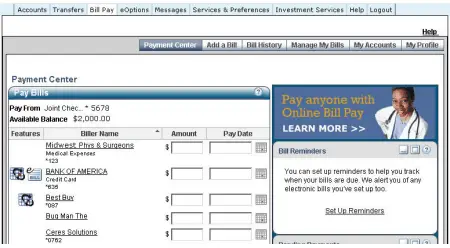

At the onset of online banking, third party vendors partnered with banks to offer fee-based bill pay services. However, today’s financial institutions offer bill pay directly to customers at little or no cost. Use your bank’s or credit union’s bill pay website to have checks or electronic payments sent to almost anyone: babysitters, Bunko club, or Bay

City Utility.

Online bill pay services use SSL to securely transmit information over the Internet. You’ll use an intuitive, web-based interface that you can easily access from any Internet-connected computer.

Getting Started

Financial institutions of all sizes offer online bill pay services. To get started you’ll first need an account with that financial institution and enough money in your account to pay your bills. Your bank or financial institution will help you gain access to their online banking website where you can check account balances, transfer money between accounts, pay bills and more.

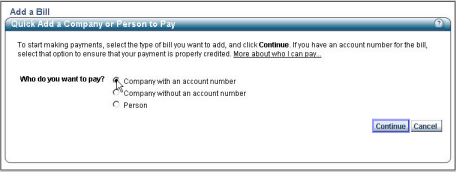

Next, you’ll need to decide who you will pay. The one-time set up for each payee can be slightly tedious, but it will pay off in long-term convenience. Most bill pay services offer a searchable list of common payees where you may find your cable or electric company. When you add these payees to your list, the bank already knows where payments need to go. Or, manually enter unique payees, such as the kid who runs the Doggie Doo Doo service or just about anyone for whom you can provide payee details like address, phone number and (usually optional) account numbers.

Making Payments

Make a single payment to a single payee, like reimbursing your cousin for planning the family reunion, or set up recurring payments so the housekeeper gets paid once a week. Pay one bill at a time or knock out a mailbox-full at once. For each payee you’ll choose when to send the payment, how much to send and from which account.

Online bill pay services maintain records of every bill you pay and provide easy-to-access reports of all your past payments. So, you’ll always know when you last paid your mobile phone bill and how much they should have received. If a vendor denies receiving payment, contact your bank. They’ll make sure you correctly executed the payment on your end then research what happened on the vendor’s end to help resolve the issue.

For many online bill pay requests, financial institutions draw funds from your account then issue computer-generated paper checks. Checks arrive in relatively discrete packaging, so if you’re paying back Grandma for a small loan, give her a heads up that the payment is coming so she doesn’t dismiss it as junk mail. You’ll also want to account for the time it takes to process and mail physical checks. Most banks suggest making bill pay requests at least five days before a payment is due.

More and more utilities, credit card companies and other vendors are making arrangements to receive direct deposits from your bank’s online bill pay service. That means your payment gets posted faster and everyone saves time, money and paper.

Service Providers’ Bill Pay

If you still don’t want to set up bill pay services through your bank, you can still pay some bills online. Some vendors and service providers will help you set up direct deposit payments from your bank account to theirs. To get started, the service provider may request a voided check, a signed authorization form or other account information. Check out the terms and conditions to make sure you’re comfortable with the automatic payment schedule.

E-bills

You may be ready to try paying bills online, but are you ready to receive your bills online? More and more companies are trying to save a dime by doing away with your paper bills. Instead, they’ll offer to send you convenient and earth-friendly e-bills via e-mail. Before you decide to take this big step, make sure you can keep a handle on bill arrival dates and payment due dates. Missing a bill because it went into your e-mail spam folder could lead to missing a payment and ultimately cost you in late fees and creditworthiness.

Safety

Some noobies worry about the possibility of fraud when paying bills online. Despite every possible precaution, fraud remains a risk-online and off. However, it may actually be safer to pay bills online. Identity thieves typically prefer low-tech methods such as stolen wallets, intercepted mail or dumpster diving.2 And, bill pay services that have their reputation at stake will usually back up their promises to securely store and transmit your data. If you’d still like some insurance, consider the relatively low cost of enrolling in an identity protection service.

1 Source: https://www.ecommercetimes.com/story/69538.html

2 Source: https://www.spendonlife.com/guide/2009-identity-theft-statistics